FxZ

Market Moving Topics - Week 16

1) Earnings reports

We are in the reporting season for Q1, and traders and investors will look closely at companies forecasts. This could lead to heightened volatility in the markets. Companies reporting numbers include Bank of Amerika, Netflix, Johnson & Johnson (Tuesday), Tesla & IBM (Wednesday), tsmc (Thursday) and Procter & Gamble (Friday). Complete Companies List by Earning Whispers: click here

2) Interest rates / Inflation rates

CPI data showed that inflation cooled down, but it is of course still too high for the FED. YOY inflation slowed down to 5%, from 6% a month earlier and monthly inflation came in at 0,1% after 0,4% in february. While both numbers where better than expected, the core CPI came in higher than before (YOY 5,6% after 5,5%). A rate cut by the FED at the end of 2023 seems to be very unlikely now. As these numbers are way above the FEDs 2% target, more rate hikes will most certainly come.

3) Recession fears

The IMF has published its lowest global growth projection since its introduction in 1990, with global growth at only 2,8% for 2023 and only 3,0% in 2024. (WTOs forecast at market exchange rates: 2,4% and 2,6%, see full table here).

4) Geopolitical Situation

China plans to limit the export of rare-earth magnetic minerals, as a means of retaliation to Washington's restrictions on semiconductor exports. Russia`s Pacific Fleet was placed on high alert and started naval drills, which included the firing of missiles.

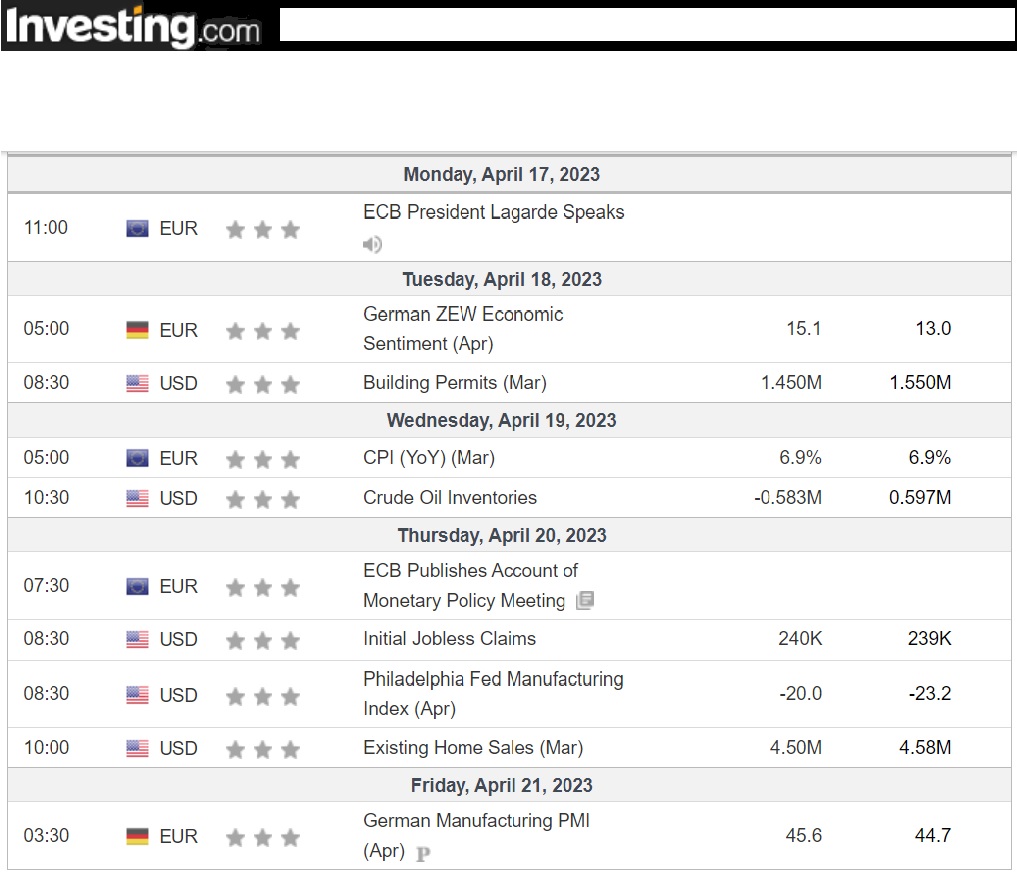

5) Economic Calendar

Other important financial dates & events this week: